Experts have discovered that countries such as the United States and China hold unparalleled sway over global financial markets in a study out of Oxford University. Original research on how power and the performance of stock markets are related, sheds light on the influence of economic superpowers.

The Global Power Equation

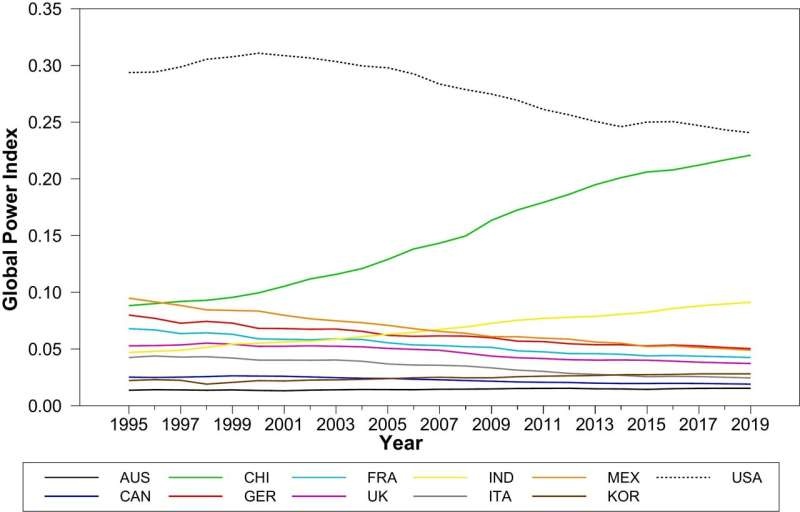

Researchers from Charles Darwin University and Griffith University in their new study go a bit deeper on the relationship between the Global Power Index (GPI) of 11 major economies such as the United States, China and Australia with stock market performance.

The conclusions are lucid: and that stock market rises or falls reverberate around the world because of the enormous financial clout of the powerful nations on earth. What the researchers found was that not only are the stock market movements of main economies such as USA and China very stable, whereas those of emerging markets like India open up to much larger oscillations with respect to other markets.

The income effects of this dynamic have major ramifications for investors desiring global diversification. Portfolio managers in such jurisdictions can expect to be better off by holding a diversified stock portfolio that does not factor the additional power of other major economies, says lead author Dr Rakesh Gupta. Rather, they should seriously contemplate potentially exposing themselves to those markets with less and dwindling global influence in order to improve the chances of scattered gains.

What People Need to Know About Sustainability and Education

The researchers also found two surprising variables that determine how the global economy looks today: environmental consciousness and education levels.

The study shows that socially responsible investors in different countries lead their domestic stock markets to diverge from each other, traders throwing up their hands in frustration as the companies they bought take off and head south on the same day. More educated populations negatively affect the convergence of stock markets as investors with greater education also tend to prefer local (vs. international) diversification which would impede the linkages between stock markets across countries.

This contradicts traditional beliefs on the drivers of economic integration. According to them, the changing dynamics of the international financial system reflect a rising commitment to environmental responsibility and enhancement in global education.

The findings of the study have critical implications for investors located in Australia. Australia, being an advanced economy but relatively small in the OECD, must go beyond closely following the United States versus China to best reap the rewards of diversification on a global scale. The researchers suggest to look on investments in lower global powered markets as providing the best risk adjusted returns.

Conclusion

A pioneering study carried out by Charles Darwin University and Griffith University has shed light on the confusing relationship between global economic superpowers and the stock market. The research shows just how powerful nations like the US and China are-and sheds light on the unexpected weight environmental awareness and education levels hold in regards to the global financial marketplace.

These revelations provide a key pointer for investors and policymakers in a world economy which is getting more elaborate and dynamically interrelated. This way they will be guided by the power dynamics of a transitioning global stage at all times, and thus benefit from a sustainable foundation for this kind of economic growth pillared on facts.