In a thought-provoking article published in Nature, researchers from the Sustainable Finance Hub warn that the use of biased metrics in sustainable finance could hinder much-needed climate investment in low- and middle-income countries (LMICs). These countries face the greatest threats from climate change but lack the necessary funds to transition their economies to more sustainable systems. The researchers call for a fresh approach to evaluating sovereign debt portfolios, one that considers nations’ historical emissions performance and future trajectories.

Addressing the Climate Finance Gap

Climate change poses a significant threat to the world, and its impacts are felt most acutely in low- and middle-income countries (LMICs). These nations face the daunting challenge of transitioning their economies to more sustainable systems in order to mitigate and adapt to the effects of a warming planet. However, their ability to do so is hindered by a severe lack of funds, as highlighted in the Nature article.

Experts from the Sustainable Finance Hub emphasize that the lack of climate finance for LMICs not only impedes their ability to respond to climate change, but also endangers the global effort to achieve the goals of the Paris Agreement. With private investors increasingly seeking to align their portfolios with the 1.5°C target, the researchers warn that the use of biased metrics could further reduce incentives for investors to lend to the countries that need climate finance the most.

The Problem with Emissions-Intensity Metrics

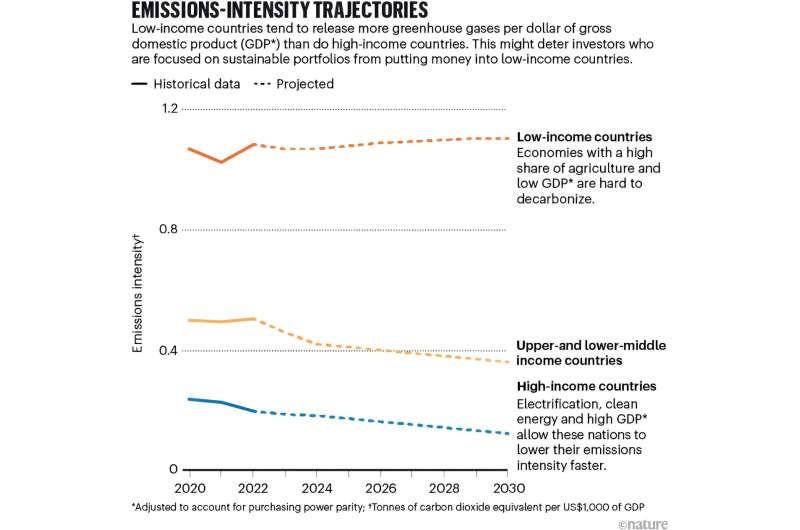

The researchers examined one example of a metric used by private investors to measure the “emissions intensity” of their lending to governments. They found that LMICs tend to fare worse than high-income economies on this emissions-intensity measure, primarily due to their lower gross domestic products (GDPs) and higher reliance on emissions-intensive industries such as agriculture.

Many LMICs already face untenable debt levels, and the researchers warn that this emissions-intensity metric could further reduce investors’ willingness to lend to these countries. This is a concerning development, as these countries are the ones that require the most urgent climate finance to transition their economies and build resilience to the impacts of climate change.

Towards a More Equitable Climate Finance Landscape

The researchers call for a fresh approach to evaluating sovereign debt portfolios, one that considers nations’ historical emissions performance and future trajectories. They emphasize the need for collaboration between sovereign investors, researchers, financial institutions, regulators, and other stakeholders to develop metrics that accurately assess the climate-related risks and opportunities associated with different countries.

By addressing the biases inherent in current sustainable finance metrics, the researchers believe that the global community can better channel climate finance to the regions that need it most, ultimately strengthening the collective response to the climate crisis. As the researchers state, “LMICs face substantial challenges raising funds from private investors as it is. If well-meaning sustainable finance metrics make it harder again, this endangers our global response to climate change, which will have powerful negative effects for us all, including the private investors making these decisions.”