One of the first-ever studies to look at emotions and economic decision-making in 74 countries provides iconic examples about how feelings influence our financial choices.

Emotions Rule the Wallet

In the traditional econometric paradigm, economic decisions are made by rational and objective individuals who are presumed to act based on common sense and reason. But the new research challenges that assumption, illustrating how emotions sway our money decisions.

Researchers from Stanford Graduate School of Business and the University of Chicago Booth School of business analyzed a cross-national dataset in data from 74 countries. This suggests that the relationship between affect and economic decision-making is not necessarily universal, but rather varies by country.

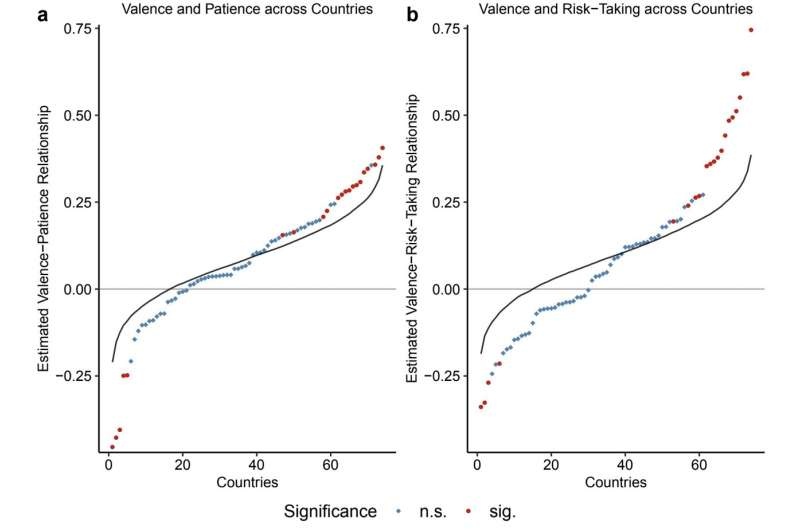

For instance, the researchers found that being in a good mood is associated with increased patience (how long an individual is willing to wait for a reward after it has been delayed ) in 53 countries and impatience in 21. There is a lot to explore here concerning the complex and often multifaceted nature of how emotions intertwine with our economic behavior.

Revealing the Differences between Countries

Among the most interesting findings of this study, however, is that there were extensive and consistent spouse differences in the way emotions predict real-world economic choices across countries.

Most studies have focused on a handful of highly developed Western societies, concluded that there is an universal set of emotions underlying economic choices. Now, a global analysis conducted in this study questions that assertion.

The strength of this relationship, however, depended on the level of economic development in a country and its degree of cultural individualism. More specifically, they found that emotions predicted the economic choices better in more economically developed and individualistic countries.

And this discovery highlights the lineaments of culture and society in researching the intricate labyrinth of emotions and financial decisions. And it further emphasises the importance of expanding the focus on research beyond just white, Western faces.

Conclusion

This study marks a watershed moment, proving once and for all the immense power of emotions over our economic behaviors, debunking the idea that human nature is almost purely rational with respect to decision making. It highlights the cross-country heterogeneity in linking emotions with financial choices thus making a good opening towards an inclusive understanding of the human economic decision-making. Further, as these researchers underscore, this work presents a plea to broaden our perspective and the study of the basic questions that drive decision making, resulting in more dynamic angles surrounding human experience.