The transition to electric vehicles (EVs) is crucial in reducing global greenhouse gas emissions, but the EV battery supply chain is heavily reliant on China, posing risks of disruptions and geopolitical shifts. This blog post explores how the Inflation Reduction Act (IRA) offers incentives to build batteries in the US and diversify the supply chain, while also examining the potential loopholes and the impact on technology choices. Electric vehicles and battery manufacturing are key focus areas.

Enabling US battery manufacturing and supply chain resilience.

One act, the Inflation Reduction Act (IRA), provides significant incentives to promote electric vehicle production and build a strong domestic battery supply chain. A team of experts at Carnegie Mellon University’s College of Engineering found that if you add up all the credits available through the IRA, it can theoretically cost more to make the battery itself.

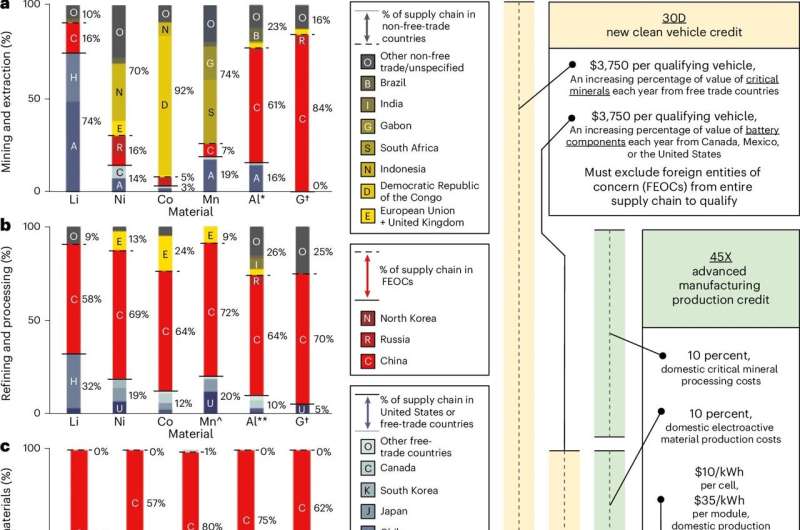

It would be difficult to qualify for the full range of credits, though, the researchers point out. A further condition is the 30D New Clean Vehicle Credit worth $7,500 but again only if no ‘Foreign Entities of Concern’ (eg China, Russia, Iran or North Korea) had a hand in the suoply chain. Called the Defense Department grant program, this provision is designed to wean competition off of Chinese materials and restructure supply chains in the US.

The Things That Will Make it Easier: Leasing and Battery Chemistry

The researchers discovered a major security hole in the IRA’s credit system. They will be able to get around the restriction on materials of Chinese origin by leasing vehicles and taking advantage of the 45W Commercial Clean Vehicle Credit, for which they will receive an incentive equal to that of the 30D credit. The stayed feature of both the supply chain and credit-only aspects of J.Crew’s securitization illustrates a tension between ability to diversify, flexibility on one hand and eligibility for credit ratings on the other.

Of equal importance is that the effect of the IRA into the upstream supply chain depends on how automakers will react to both ‘Foreign Entities of Concern’ and Leasing, important findings for policy making. However, the study suggests that safer lithium iron phosphate batteries could fall into a lesser incentive tier than nickel- and cobalt-based batteries with further potential for boosting resilience in the supply chain.

Looking Ahead: A Blueprint for the Changing Policy Environment

The Carnegie Mellon University researchers’ IRA is thus especially targeted at encouraging diversification in downstream battery manufacturing, they stress, with the effect on upstream supply chain diversity being left to strategic decisions by the automakers.

The policy likely will have to make some adjustments if large fleets of automakers dart towards more leasing-heavy business models to bypass the supply chain bottlenecks in order to stay effective. The researchers promise continued title monitoring and analysis to improve the IRA’s effectiveness in helping US electric vehicle battery supply chain security and resiliency.